chevron_left

-

play_arrow

play_arrow

The BTLS Show ™ Replay

-

play_arrow

play_arrow

Bubba Army Radio™ Only @ HQ

-

play_arrow

Bubba Exclusive Podcast |April 17th 2024 | Operation Pigmentation

-

play_arrow

Bubba Exclusive Podcast |April 16th 2024 | Brandi Love with Clem & Kush

-

play_arrow

play_arrow

Lummy’s Sports Show | April 17, 2024 Bubba Army HQ

-

play_arrow

play_arrow

The BTLS Show | April 17, 2024 Bubba Army HQ

-

play_arrow

play_arrow

The BTLS Show | April 16, 2024 Bubba Army HQ

AD

ENLISTMENT BENEFITS

The BTLS Show Hot Mic + Bubba Army Radio exclusives Bubba Uncensored, The Anna Hummel Show, Lummy’s Sports Show + unlimited access to The Bubba Army Archive and every show dating back to 2006 + Bubba Army Podcast + exclusive offers, and more!

MEET THE HQ

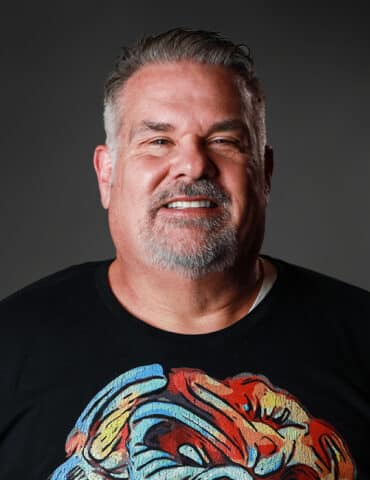

Host

Bubba

My name is Bubba the Love Sponge Clem® I'm the host of The Bubba Army Show. I am a Taurus the Bull sign, which signifies strength and tenacity. Don’t Google me.

Co-Host

Anna

I started at the Bubba Radio Network in June of 2020 after I made an ill-timed tweet which caused me to be fired from my previous employer. It was the best dumb decision I ever made.

Co-Host

Seth

Hey it’s Lummy! I am a Co-Host and the show historian. I also am the “Goat Whisper”, taking care of the show goats (Baby and Hootie) My sign is a Cancer. When I’m not at the studio I’m enjoying time at home with my wife and son.

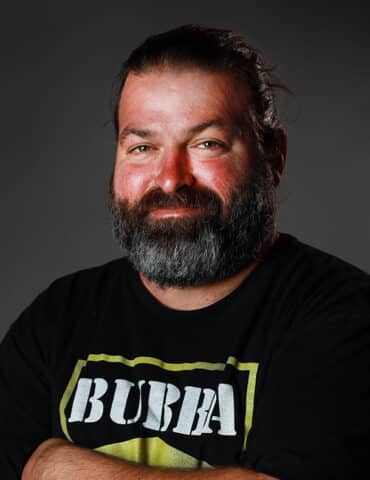

Co-Host

Lummy

Hey it’s Lummy! I am a Co-Host and the show historian. I also am the “Goat Whisper”, taking care of the show goats (Baby and Hootie) My sign is a Cancer. When I’m not at the studio I’m enjoying time at home with my wife and son.

Operations

MACHO

Macho here. Operations Manager of BRN and Chief Engineer for the Army. When I am not Wiring Stuff up at the BRN, you can find me Super-Setting in the GYM.

AV Guy

Rhett

Rhett Matthew, a true radio enthusiast hailing from the vibrant city of Tampa, FL, is more than just an accomplished professional in the world of audio and video engineering. He's also a devoted dachshund enthusiast, often found in the pursuit of his loyal companion, Scout.

Merchandise

Erica

Hello, I am Erica Hernandez, Bubba’s girlfriend better known as the “Merch Crick.” I am a Libra, which is why I am in constant need of balance and justice in my life. I am a retired law enforcement officer, who now finds myself helping out around the studios in any way that I can. If you happen to buy merch, you may get a little message in cursive writing from me. I am not a paid employee but I love the fact that everyone in the BUBBA ARMY makes me feel like part of the family.

Regular Guest

Jay

What’s up Army? It’s the Spitting Cobra, Jay Diaco, Esq. When I’m not surfing in Costa Rica, I’m here to speak my mind, defend Bubba and the Bubba Army, and to smooth over whatever Shenanigans Dr. Dan, Esq. said while shot out of a cannon!

Regular Guest

Brian

I’m Brian Motroni, but Bubba has dubbed me Babyface. (I used to look a lot younger than I do now.) He also calls me the smarmy, toothy, counter-programming liberal snowflake….and, well, he isn’t wrong about anything, except maybe the snowflake part. I can take a ribbing as good as I can give one. I’m one in a longline of lawyers that Bubba keeps around, and boy does he need us!

Occasional News & Other Updates from HQ. Never more than once a month. Sometimes not even that. We make it easy for you to unsubscribe at any time.

© 2023 Bubba The Love Sponge® & Bubba Army Media. All rights reserved.

AD